Building insurance covers the cost of damage or destruction to a property's structure. If a property is damaged, building insurance will help pay for the repairs. It should also cover the full cost of a rebuild, including demolition, site clearance, and architects' fees.

Building insurance currently makes up, on average, almost 20% of service charge fees, with rates having risen by nearly 70% in five years.

We held a webinar with Rob Mayo, Chief Executive Officer at Insurety, and Nigel Glen, Non-Executive Director of Emeria. They discussed why building insurance rates are increasing and what managing agents can do about it.

What does building insurance cover?

It typically covers:

- walls, roof, and floors

- fixtures and fittings like kitchens and bathrooms

- permanent features like garages and sheds.

It can also include common areas like hallways, gardens, staircases and car parks. It means that any damage within shared spaces is adequately covered.

Building insurance covers damage or loss caused by:

- fire, explosion, storms, floods, earthquakes

- theft, attempted theft and vandalism

- fallen trees, lamp posts, aerials or satellite dishes

- subsidence (when the ground beneath a property sinks, which pulls the building's foundations down with it)

- frozen and burst pipes

- vehicle or aircraft collisions.

What doesn't building insurance cover?

The specific events covered will vary depending on the policy, but it usually doesn't cover belongings inside the property. Contents insurance is needed for this. There could also be different requirements for it to cover a building, such as the occupier having a mortgage.

How does building insurance work?

If something goes wrong in a property, which results in damage, the managing agent makes a claim to their insurance company. If the situation is covered, the company will calculate how much money to give the managing agent to replace anything damaged or destroyed.

The occupier will typically need to pay part of the claim themselves, which is known as the excess.

Example

- An emergency has taken place. The washing machine braided cable has broken and has caused flooding.

- The property manager should contact their broker immediately to report the issue. However, it is not the broker's job to stop the leak, so a plumber should be called out to stop it.

- Once a claim is reported to the broker, they will quickly look at supporting evidence, including a description of what happened and photographs.

- From this, the broker will determine which point the claim fits within under the insurance company contract. The most common is an escape of water, which this example would fall under.

- The broker will present the claim to the insurer.

- The insurer will advise the broker on what it needs, such as immediately remedying low-level insurance claims.

The turnaround time for this can be as little as one hour. However, if it is a more complex claim, the insurers will appoint a loss adjuster—a third-party firm that acts as the insurance company's eyes and ears on the ground. The loss adjuster will put together a scope of work and pricing and present this to the insurer for its agreement.

Another way of dealing with this is through a delegated claims authority, which takes the power for low-level claims away from the insurer and allows brokers to agree on claims on behalf of the insurer. This can speed up processes even more for the property managers and the leaseholders.

In this case, the person who caused the leak will need to pay the excess; however, this will depend on the lease.

How does building insurance work in block management?

Property managers deal with brokers rather than going straight to insurance companies. Brokers are people who buy and sell goods or assets for others. In this case, brokers are always involved in an advised sale, which is anything with a business orientation, and provide advice on the covers required for the end consumer.

Do you need building insurance?

Yes, a property manager must cover the buildings they oversee.

How much does building insurance cost?

Building insurance, on average, costs £298 a year per unit, according to the Association of British Insurers (ABI).

Insurety's Rob Mayo explained that insurance companies have had to deal with rising costs themselves, with Nigel Glen adding that construction costs have been a major contributor.

Rob said: "[Insurers] have had a hard run, certainly post Brexit. Their investments haven't provided the incomes that they have done historically, and the Financial Conduct Authority require insurers to now hold larger sums of money in reserve to pay claims. That's effectively money that sits in an account that an insurer can't do anything with, so it's kind of dead money. It's just there to cover the insurance liabilities. Costs have also increased significantly. As we've seen on some of the latest sites, the costs of claims have gone up hugely over the last 10 to 15 years."

— Rob Mayo, Chief Executive Officer

What does the data on building insurance in service charges look like?

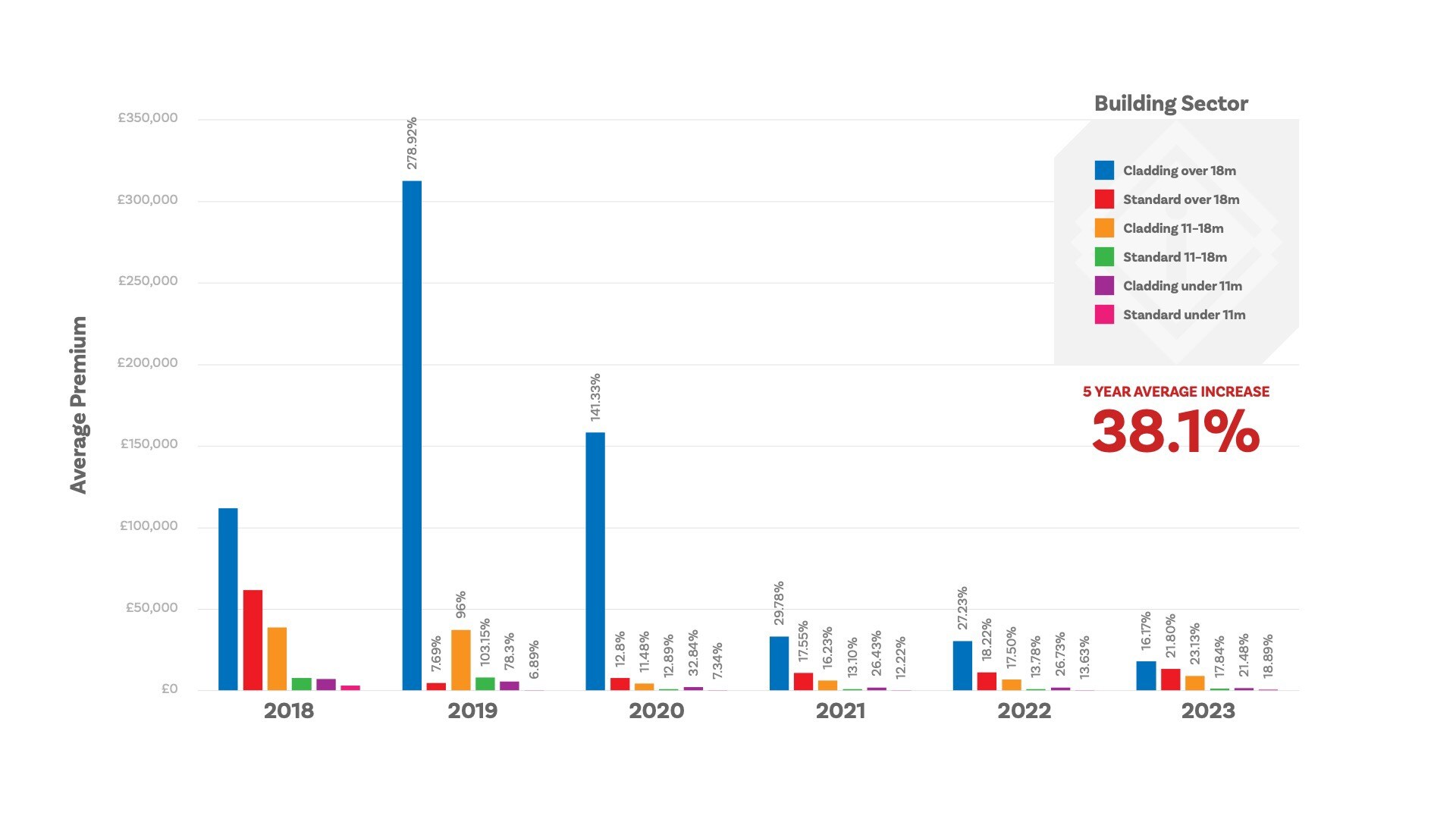

Data from The Property Institute suggested that, based on a pool of 108 estates, insurance had increased by 92% across the past five years.

Rob said: "I was quite shocked and upset the perception was that the industry was letting the leasehold sector and property managers down to that extent. The TPI data was based on 108 developments and a number of our clients provided some of the data that was put into that. It became clear that the data our clients had put forward was on their large and complex cases."

Following this, Insurety focused on 8,200 developments that it is responsible for insuring, which Rob described as a "very different picture".

"What it does show is that 18 months after Grenfell, the high rise above 18 meters buildings had a huge increase in premiums," Rob added. "This is early 2019, late 2018, and that's when the insurers woke up to cladding, what cladding was, and what fire safety was in high rise."

Graph courtesy of Insurety

There has been a significant reduction in increases following 2019, as shown in Insurety's graph.

"That was slightly skewed last year because the building's cost index concerning building materials went through the roof," Rob continued. "But that seems to be coming down again. I think it shows quite clearly that the insurance industry is not necessarily letting all property managers and leaseholders down; it is letting everyone down still on what is perceived to be a high-risk building. Those premiums are still too high."

The makeup of the claims going through Insurety revealed that water is where the biggest issues lie.

What can property managers do about rising building insurance rates?

Rob explained that property managers should ensure that underwriting details are correct. Insurety sees many managing agents failing in this area, and buildings are rated incorrectly as a result.

He added that property managers should monitor risk improvements, especially if they come from an insurer. They should get an RCA, ensure evaluations and fire risk assessments are up to date, and ensure health and safety are up to a good standard.

Property managers' questions answered

Rob answered pressing questions asked by property managers about building insurance.

"It's great that the industry actually understands under- and over-insurance better than it used to. But I worry about desktop reinstatement cost assessments. Are they inherently risky if the RCA surveyor has never been to the building?"

"I think desktop valuations do have a use in the market. They are excellent as an interim measure for developments. A full onsite RCA should be conducted every three years without fail, but as we saw last year, a lot can happen in a three-year period. A desktop surveyor is a good way to pressure test building valuations between three-year periods. However, I would not want to rely on a desktop valuation for a development that hasn't been fully valued for several years."

"Can leaseholders obtain insurance to cover the excess of a block policy in case they accidentally cause water to escape?"

"In short, no. There isn't any such product that will cover EOW claims excesses. The main issue comes back to the frequency of water claims. Any insurer offering an excess protection policy would have to charge such a high premium that it wouldn't be financially viable for most leaseholders."

"PoolRe (government-backed) terrorism insurance might be double the premium of a Lloyds terrorism product. Why is this? Aren't RMCs just going to plump for the cheaper product as long as it complies with the leases?"

"The PoolRe scheme tends to be premium-heavy and is often not the best option for developments. Many of the other providers will offer cover for Terrorism to Exclude Chemical, Biological, Nuclear and Radioactive threats (CBNR Cover). In the case of nuclear threats, there are no known terrorist cells that have nuclear capabilities, and as such, a nuclear attack on the UK would be deemed a State attack and, therefore, an Act of War, which is excluded. With this in mind, it begs the question of whether it is worth paying a higher premium for cover that cannot be claimed. There are many differences in terrorism insurance, which I am happy to personally go through with anyone who would like to know more."

"It seems to be an open secret that the FCA is investigating some brokers. Is this a commission thing that they're investigating?"

"Some brokers have been investigated for the commissions/earning structures they have demanded. The FCA has even named and shamed a couple of times, which is unusual but clearly shows the increasing pressure the regulator is applying on the sector. Transparency and honesty are the two traits all property managers should look for in their brokers. As I mentioned during our webinar, the property manager is as open to investigation by the FCA as us brokers, making it more important than ever for property managers to work with the right broker."

Want to hear more from Rob and Nigel?

Watch our webinar on what you can do about rising Building Insurance rates.

Disclaimer: Nothing on this site constitutes legal advice. Specialist legal advice should be taken in relation to specific circumstances. The contents of this site are for general information purposes only no warranty, express or implied, is given as to its accuracy and we do not accept any liability for error or omission. We shall not be liable for any damage (including, without limitation, damage for loss of business or loss of profits) arising in contract, tort or otherwise from the use of, or inability to use, this site or any material contained in it, or from any action or decision taken as a result of using this site or any such material. Some of the material on this site may have been prepared some time ago so it may not reflect the up-to-date position of any relevant law.

Keep reading...

Read more on

#{ item.name }

|

No posts available

Be the first to hear about new content for Property Managers.

eBooks and webinars, always free

- Data-driven industry insights

- Compliance and legal updates

- Property management best practices